IBM: Open Insurance

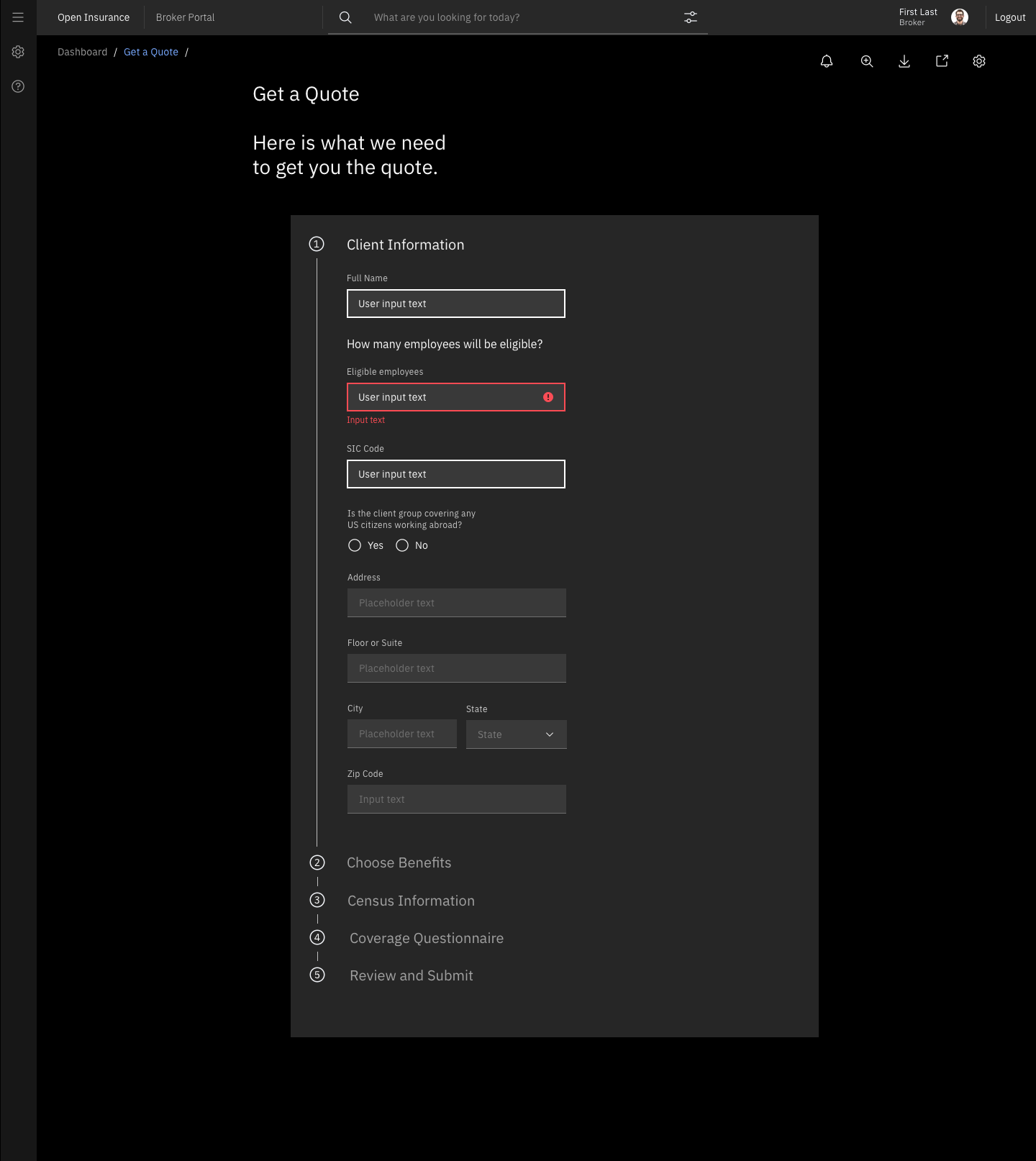

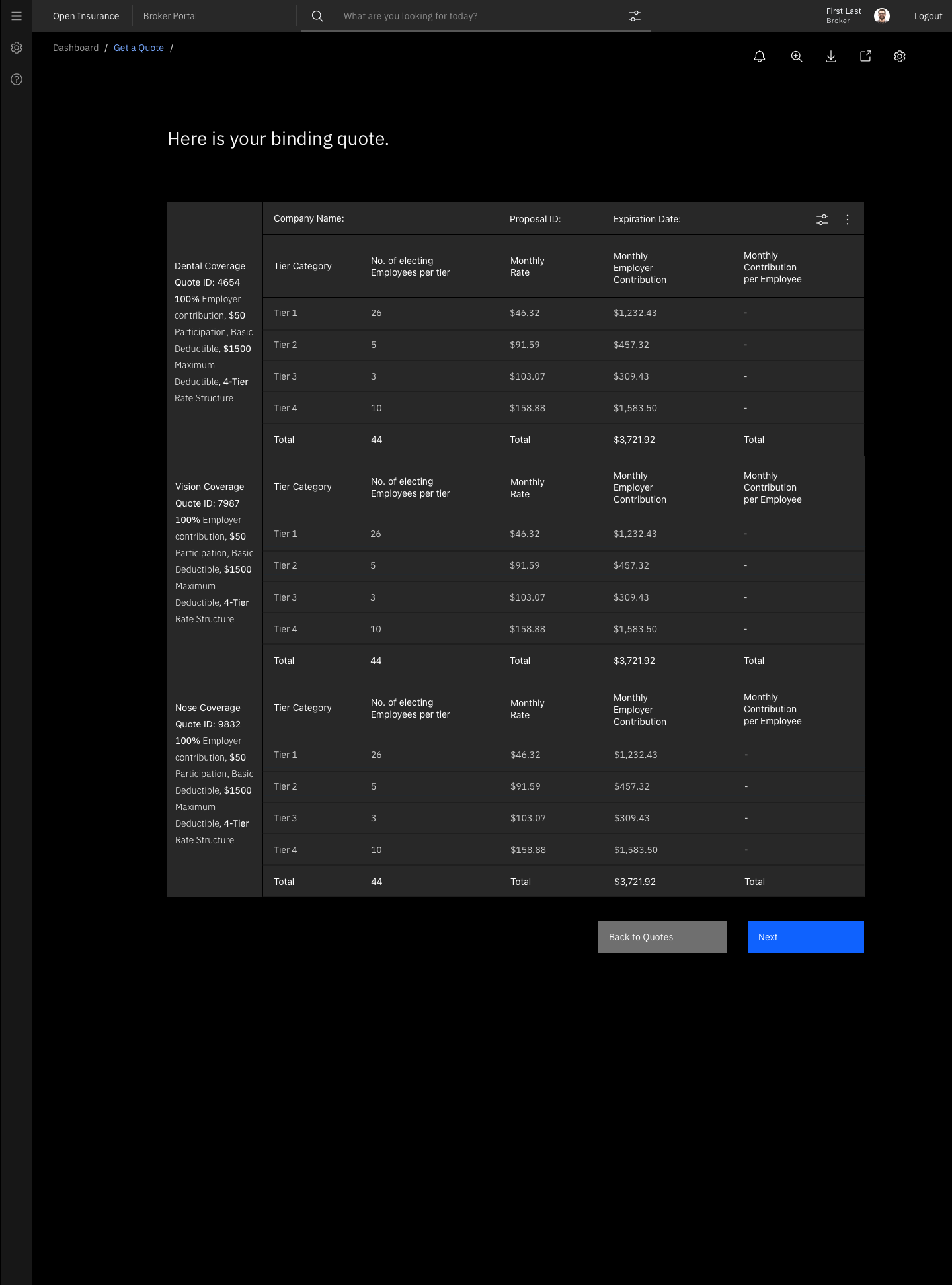

Open Insurance is an insurance platform for your essential corporate coverage. With the team, I had the responsibility of building the broker experience. This would be where the broker is able to create, negotiate and monitor his/her policy.

The flow

How it worked out

Focus on the user

In order to transform Open into a service platform that sells trust and lifts business result, we first needed to move from a product-driven to a user-driven approach. This means putting customers at the center. We guided their team to focus on the true needs of professionals by collecting and analyzing the right user data in the decision-making process. To get a full picture of the customer, we mapped different user flows and pinpointed the metrics in the customer journey that truly drive results.

Start small, fuel with data

To look for opportunities in the customer journey and improve the sales funnel, we followed a process of ongoing, insight-driven optimization. This means starting small with a proof of concept, and experimenting and learning whether our ideas actually contribute to a better user experience.

Connecting the dots

The next step in this continuous optimization process is to create new content and tying all different landing pages and funnels together, using the right technologies and tools. We’ll also roll out the same process and principles on other projects to make them both user and future friendly.